Interactive Brokers

$0 for stocks, ETFs, options (plus $0.15 to $0.65/options contract fee)

Loading...

The German government is maximising the modest leeway it has under the debt brake to inject public funds into the economy, but the measures are insufficient for addressing large and widening investment gaps.

Comprehensive reform of the constitutional limits on running structural budget deficits larger than 0.35% of GDP will remain an important policy challenge for the current multi-party coalition and future administrations to address Germany’s EUR 300bn investment backlog.

The government’s use of all possible levers to reduce overall spending, increase investments and remain compliant with the debt brake confirms this challenging balancing act. The 2025 budget will be the coalition’s last budget before the next federal election in autumn 2025. Total spending is projected to decline by 1.7% YoY to EUR 481bn with higher spending in areas such as environment & consumer protection (+10.3%), housing & urban development (+7.4%), digital & transport (+5.0%), family (+4.1%), education & research (+3.9%), home affairs (+3.0%) and defence (+2.5%), with the biggest reductions for the foreign office (-12.5%), economic cooperation (-8.4%) and economy & climate protection (-7.5%).

Even though the government’s draft budget includes borrowing of around EUR 44bn, or 1% of GDP, and only modest spending cuts, the measures aimed at boosting investments, while welcome, remain limited, and unlikely to boost Germany’s sluggish economy, which Scope Ratings estimates will grow just 1.1% in 2025 after 0.2% this year.

Moderate tax cuts are projected to be partially financed through EUR 6bn in additional tax revenue generated by a rebound in growth, which, however, relies on relatively optimistic projections. Output in Germany remains near pre-Covid levels at this stage, well behind the euro area average (+3.9pps compared with 2019) and other sovereigns having AAA Scope ratings such as Sweden (+4.8pps), the Netherlands (+6.2pps), Switzerland (+6.5pps) and Denmark (+9.5pps).

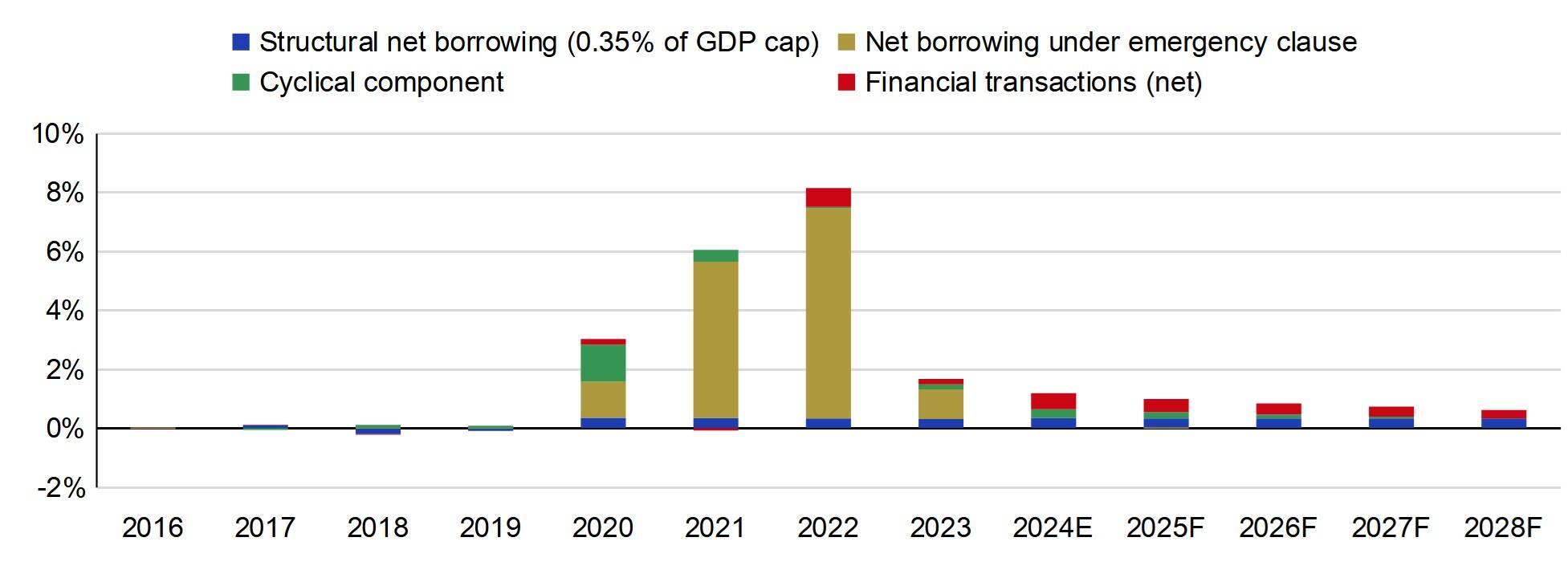

Figure 1: German government to continue borrowing around 1% of GDP a year in conformity with the debt brake

% of GDP

Source: German Federal Ministry of Finance, Scope Ratings. Note: Net borrowing as defined under Germany’s federal debt brake provisions.

The government envisages to make fuller use of permissible forms of borrowing under the debt brake to help finance investment using three main components: maximum borrowing under the allowed 0.35% structural deficit (around EUR 14bn), the cyclical component (EUR 10bn; a technical tweak to the calculation has created some budgetary room), and spending on financial transactions (in net terms, EUR 20bn).

Under the government’s financial planning presented until end-2028, these elements would continue to be used to a broadly similar extent (Figure 1). This will unlock relatively moderate sums, but it marks a clear deviation from the pre-pandemic financial policy of a balanced budget or “black zero”, given economic, political, geopolitical and legal challenges facing current and future governments.

Financial transactions are increasingly used as a workaround to finance public investments absent a reform to the debt brake (at national and regional levels). These transactions (in net terms) are excluded from debt brake limitations because they are technically net neutral for the government’s financial position as the borrowed funds are matched with corresponding assets.

Of the EUR 19.6bn in (net) financial transactions budgeted for 2025, EUR 5.9bn will be used to increase state-owned railway operator Deutsche Bahn’s equity, while EUR 12.4bn will be used to establish Germany’s old-age provision fund (Stiftung Generationenkapital). To ease budgetary pressures, the government is also looking into extending financing of EUR 8bn to Deutsche Bahn and Deutsche Autobahn GmbH for railway and road infrastructure via loans, i.e. financial transactions, instead of grants.

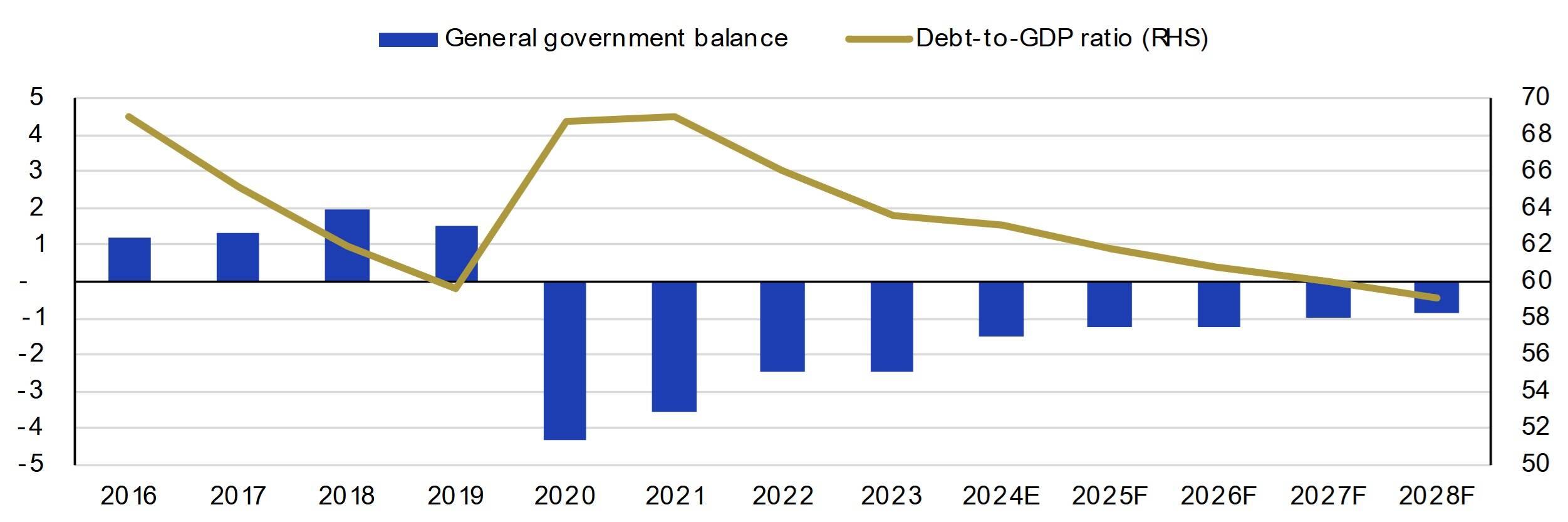

Figure 2: Germany’s debt ratio to keep declining, despite net borrowing allowed under the debt brake

General government balance and debt of Germany, % of GDP

Source: Macrobond, Eurostat, Scope Ratings forecasts

Germany retains comfortable fiscal space, as highlighted by its safe-haven status, excellent funding conditions and gradual downward trend in the general government debt ratio to below the 60%-Maastricht threshold by 2028 (Figure 2). Annual general government deficits will average around 1.1% until 2028.

Longer term, the main credit challenges for Germany include its ageing and declining working-age population, as well as balancing the energy transition while maintaining its international competitiveness. Higher investment spending would thus help increase the economy’s growth potential and is necessary to meet long-term demographic and environmental challenges.

Continued delays in addressing these structural challenges will contribute to Germany’s stagnating productivity, which remains only marginally above 2008 levels. This will also hold back near-term and potential economic growth, which Scope Ratings estimates at 0.8% per year, which also curbs growth across other EU countries as Germany is the top destination for merchandise exports for 15 of 27 EU member states, including for Czechia (33% of exports), Austria (29%) and Poland (28%).

Low public net investment will thus continue to be a problem for Germany’s economic outlook, but also the EU’s, which is unlikely to be resolved without constitutional reform, particularly since the Constitutional Court ruling from November 2023 restricted the use of emergency borrowing spread over multiple years.

$0 for stocks, ETFs, options (plus $0.15 to $0.65/options contract fee)

XRP rises 0.37% to $0.5665; broader crypto market gains 1.13% to reach a $2.051 trillion market cap. Investors anticipate an SEC appeal in the Ripple case, as XRP retreats from $0.6434 to $0.56. XRP-spot ETF hopes remain uncertain amid SEC appeal threats; legal clarity awaited by ETF issuers.

U.S. building permits fell 4% in July 2024, signaling a potential slowdown in future residential construction activity. Housing starts dropped sharply by 16% YoY, with single-family starts plummeting 14.1% from June 2024's revised figures.